So the worst has come to pass - you realise you parted with your money too fast, and the site you used was a scam - what now? Well first of all, don’t despair!!

If you think you have been scammed, the first port of call when having an issue is to simply ask for a refund. This is the first and easiest step to determine whether you are dealing with a genuine company or scammers. Sadly, getting your money back from a scammer is not as simple as just asking.

If you are indeed dealing with scammers, the procedure (and chance) of getting your money back varies depending on the payment method you used.

- PayPal

- Debit card/Credit card

- Bank transfer

- Wire transfer

- Google Pay

- Bitcoin

PayPal

If you used PayPal, you have a strong chance of getting your money back if you were scammed. On their website, you can file a dispute within 180 calendar days of your purchase.

Conditions to file a dispute:

- The simplest situation is that you ordered from an online store and it has not arrived. In this case this is what PayPal states:

"If your order never shows up and the seller can't provide proof of shipment or delivery, you'll get a full refund. It's that simple." - The scammer has sent you a completely different item. For example, you ordered a PlayStation 4, but instead received only a Playstation controller.

- The condition of the item was misrepresented on the product page. This could be the item was stated as brand new, yet has obvious signs of use.

- The item is missing parts or features and this was not disclosed. For example, you purchase a shelf including all screws for assembly, yet on arrival, these are not included.

- The product you received is a counterfeit version that was sold as genuine.

Credit Card or Debit Card

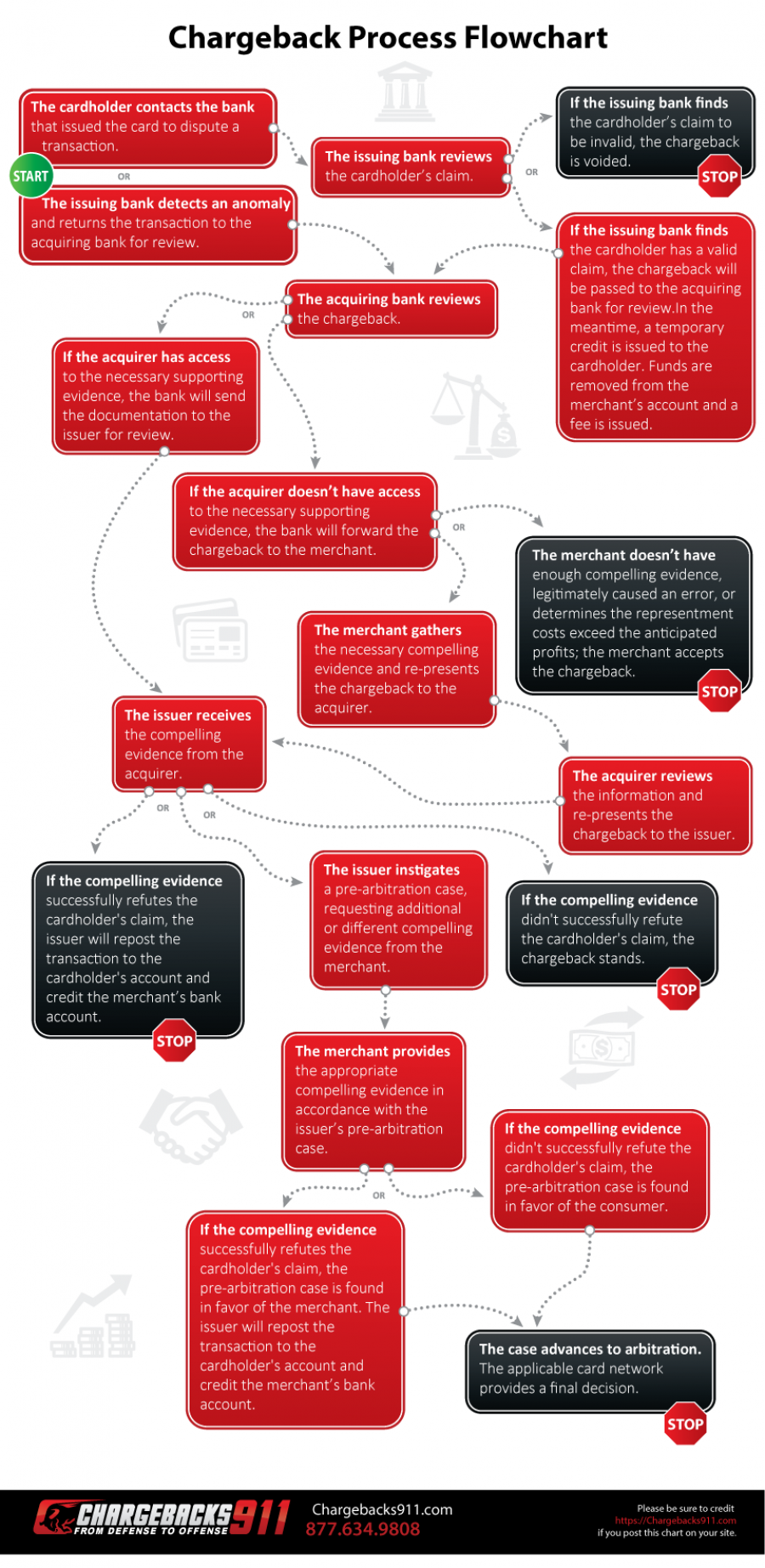

If you have paid the online store via a credit or debit card, your best bet is to go through your card’s bank and check if they have a section on ‘disputed transactions’ or mention the ‘chargeback’ process. This process can be rather complicated - as demonstrated perfectly by this infographic from Chargebacks911.

But just what is chargeback? Money Saving Expert states that chargeback is useful for when you buy something online and the goods/services are: faulty, not provided, not delivered to you as the company went bust. Your bank will go directly to the merchant’s bank to refund the amount back to your account (if the claim is valid). The period in which you have to ask for a chargeback is 120 days of when you paid or noticed the issue.

For those of you from the United Kingdom, you have a friend in Section 75 of the Consumer Credit Act 1974. If you’d like to know more, check out the full legal text over at Money Saving Expert. What does it mean for you? Well, this piece of protection means that if you paid more between £100 – £30,000 you can get your money back if you don’t receive the item ordered or something was as it should have been. The difference between this and chargebacks is that this isn’t a voluntary scheme from the card providers. These protections are enshrined in law.

Why we at Scamadviser think this protection is great for consumers is that it also protects users from a company who has let you down and then goes bust.

Note: Be careful not to use a third-party such as PayPal when paying by credit card. This can invalidate your right to claim under Section 75. For further details look here.

Bank Transfer

Which.co.uk has the following to say about getting your money back from a bank transfer: When you have fallen victim to a scam that led to you transferring money to another bank you should contact your bank immediately. Once notified,they can attempt to recover the funds. If this is not successful, you can make a complaint to your bank or get in contact with your local financial ombudsman. Furthermore, Which.co.uk states that contacting the authorities and having a case number on hand can help with this process.

Wire Transfer Service

Beware of using money transfer services. Which.co.uk points out that using services such as MoneyGram, Pay Point or Western Union (a favourite among scammers) can make it difficult to get your money back. The best advice here is that if you aren't sure about the transaction, do not choose this method of payment.

Unauthorised Mystery Payment

Are you looking at a financial statement with an odd purchase? Perhaps an amount that is deducted by a company you have no memory of? You're not alone, and it could be an unauthorised withdrawal. If this is the case, contact your bank as soon as possible. Depending on where you live there may be regulations in place to protect you and perhaps provide a refund.

Google Pay

Do you think someone has used your Google Pay account without your permission? Perhaps there has been a strange payment you cannot remember making. Well, don't worry! Google has a dispute system in place to help you out. Head here to read more on what to do if you wish to dispute, report or cancel a payment.

Bitcoin (and other cryptocurrencies)

Sadly, cryptocurrency transactions are impossible to trace and reverse, which makes recovering them a big challenge. In most cases, there is almost no hope of recovering the crypto coins. You can try contacting the company through which you made the Bitcoin transaction and present your case for a refund. It is then up to the company to determine whether they can issue you a refund as per their policies.

#scammer #scam